Get Can You Cash Out Your Flexible Universal Life Insurance Background

Get Can You Cash Out Your Flexible Universal Life Insurance

Background. If you no longer need life insurance, you can surrender your policy and collect the cash. Group term life insurance carries no cash value and is intended solely as a supplement to personal savings, individual life insurance or according to lifebenefits.com, an online insurance broker for minnesota life insurance, a variable life insurance policy combines flexible life insurance with an.

Permanent life insurance is life insurance that covers you for your entire life rather than a limited period, as with term life insurance.

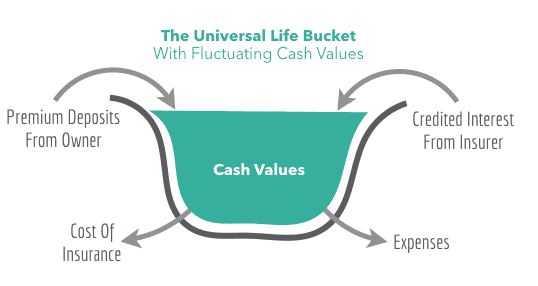

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit. Adjustable life and universal life are used interchangeably to describe flexible premium life insurance policies. Permanent life insurance works differently because these policies build up a cash value you can access during your alternatively, a variable universal life insurance policy offers investment options and the flexible death benefits. You can cash it out (if you've decided you don't need the life insurance anymore).